The Absurdity of Taxes and Financial aids on Vehicles in France

Context: The European Union has proposed a plan to phase out the sale of new gas-powered vehicles by 2035. This is part of the EU’s broader strategy to reduce carbon emissions and achieve climate neutrality by 2050.

France, the EU’s “exemplary student,” has raised taxes on gas-powered vehicles and introduced financial subsidies for e-bikes to promote soft mobility.

At first glance, these measures might seem like a positive step for the climate. However, one doesn’t need to be a genius to see that this isn’t true. They seem to impact personal freedom and how French citizens can spend their money more than they advance ecological goals.

Taxes on Gas-Powered Cars

Increasing taxes on gas-powered cars (ecological penalty), while offering financial aid to purchase electric cars, is intended to discourage the purchase of new gas-powered vehicles.

From an ecological standpoint, it’s challenging to determine whether electric cars are truly more environmentally friendly than gas-powered cars.

Both types of cars must be manufactured and transported, which consumes energy and resources. Additionally, electricity generation requires resources as well, and even renewable sources such as solar panels must be manufactured and transported. The questions of battery repair and recycling also pose environmental concerns.

However, electric cars offer clear benefits in urban areas with heavy traffic. Since they don’t emit exhaust gases, they help reduce air pollution in big cities.

Given these observations, one might question whether the imposition of such taxes is justified. Are these measures truly necessary for achieving the desired ecological impact?

Let’s take 2 distinct use cases.

Case 1: Marie

Marie lives in a rural area and commutes to a city 20 kilometers away from her home. Due to the lack of public transportation options, she finds the car to be the most convenient mode of transportation. For Marie, the type of power source for the car is irrelevant; she just wants to travel from point A to point B.

Marie decides to purchase an electric Renault Twingo, which is priced at €21,000 (including 20% VAT).

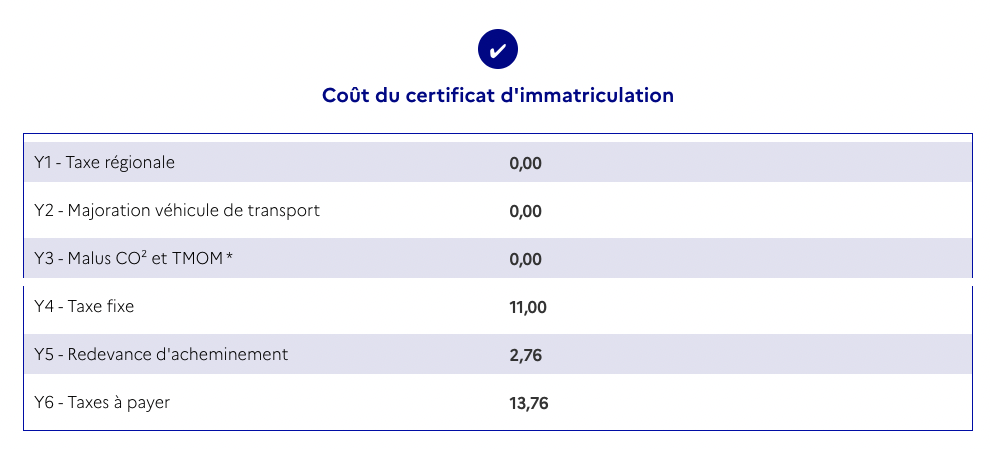

Registration cost = €13,76 (0.066% of the vehicle price).

Marie might be eligible to financial aids, which could reduce the price of the car.

Case 2: Jean

Jean’s dream has always been to own a Ferrari for casual excursions with his wife on sunny Sundays. He has worked hard to afford the car of his dreams. During the week, Jean can walk to his office, so he does not rely on a car for daily commuting.

Jean decides to purchase a brand new Ferrari Roma, which costs €246,000 (including 20% VAT).

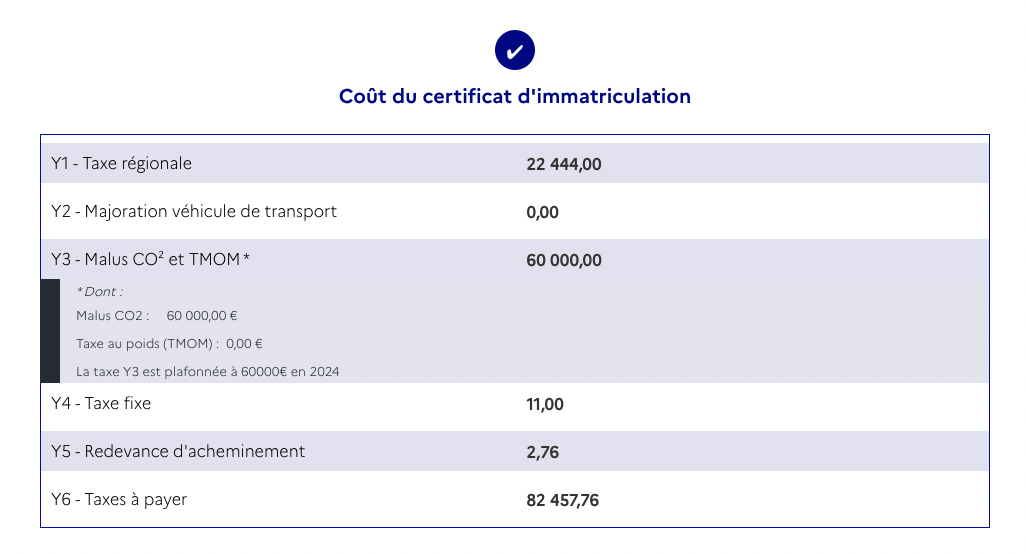

Registration Cost = €82,457.76 (33% of the vehicle’s base price).

Price without taxes (VAT, registration cost) = €196,800.

Total price with all taxes = €328,457.76, which includes

- Base price: €196,800

- VAT: €49,200 (20% of the base price)

- Registration cost: €82,457.76

Purchasing the car involves paying €131,657.76 in taxes and fees, which is 67% of the base price.

Pas mal non ? C’est Français.

Why it’s totally non-sense

The approach doesn’t consider how the vehicle will be used.

To make this more apparent, let’s consider a third use case.

Case 3: Emilie

Emilie purchased a second-hand diesel SUV, which was sold 12 years ago. She commutes 150 kilometers on the highway each day to work and back home.

Due to the age of the SUV, the registration cost will range between €500 and €1,000.

Now, let’s compare Emilie’s situation with Jean’s.

Who is the greater environmental impact here? Emilie, who drives her SUV long distances daily, or Jean, who only drives his Ferrari occasionally on the weekends and is likely to keep it for decades?

While Emilie’s daily commute in a diesel SUV contributes significantly to emissions, Jean’s use of his Ferrari is limited and sporadic, potentially resulting in a lower overall environmental impact.

Liberty Under Threat

France doesn’t like people having money and seems to discourage people from spending their money as they see fit—unless they are government officials living off taxpayers’ contributions.

This might explain why Jean faces such high taxes.

The situation highlights a crucial issue: the French government dictates how people should spend their money through excessive taxes and financial incentives.

The ideal approach would be to tax based on usage, rather than taxing individuals’ purchasing choices.

An even better solution would be to focus on providing incentives rather than imposing taxes:

- Enjoying Your Ferrari: If you want to drive your Ferrari on weekends for leisure because you worked hard and earned it, you should be free to do so without excessive taxes.

- Choosing an Electric Car: If you’ve opted for a small electric car for your daily commute instead of a gas-powered one despite having the choice, you should be rewarded for helping to reduce city pollution (with lower income taxes this year for instance).

By adopting a fairer and more balanced approach, individuals would be encouraged to make environmentally friendly choices without sacrificing their personal freedom.

E-bikes

Mechanical bicycles are among the most ecological vehicles available:

- They allow to cover long distances with ease.

- With proper maintenance, they can last for decades.

- Only a few parts need occasional replacement, such as tires, brake pads, cables, and the chain, making them cost-effective.

- Recycling is simple: merging two broken bikes to create a working one.

- They are powered by legs, providing healthy and inexpensive energy.

Then came the introduction of the e-bike. Although the “e” in the name suggests an ecological advantage, an e-bike is essentially a mechanical bike with more parts, making it more complex to repair, less recyclable, and reliant on external energy sources.

Despite these drawbacks, e-bikes can encourage more people to use bikes, and they remain more energy-efficient than cars. Therefore, depending on the context, they represent a valuable innovation.

In France, there are various financial aids available for purchasing a new bike. Notably, the subsidies for e-bikes are much higher than for mechanical bikes.

This disparity may seem reasonable at first because e-bikes are typically more expensive. However, they are also less ecological.

While cars claimed to be environmentally friendly benefit from low taxes, bikes with a higher environmental impact receive fewer subsidies.

Pas mal non ? C’est Français.

This leads to situations such as:

- People shifting from mechanical bikes to expensive e-bikes because, with all the financial aids available, the e-bikes are sometimes cheaper.

- Uber Eat Delivery workers, often immigrants, riding brand new expensive e-bikes while working long hours in challenging weather conditions for low wages.

- Eligibility for these financial aids is based on having a low income. If you earn an average salary, you may find yourself paying social taxes that fund new e-bikes for lower-wage individuals. Ironically, they may end up with a better bike than you.

- Some individuals are using their financial aids to buy a bike at a low cost and then reselling it for profit. This ‘free money’ comes from the social taxes paid by those who work for a reasonable income.

Pas mal non ? C’est Français.

Although I don’t have concrete data on this, based on these observations, it seems plausible that the financial aids for e-bikes may actually have a negative impact on the environment.